Reverse inflation hedge

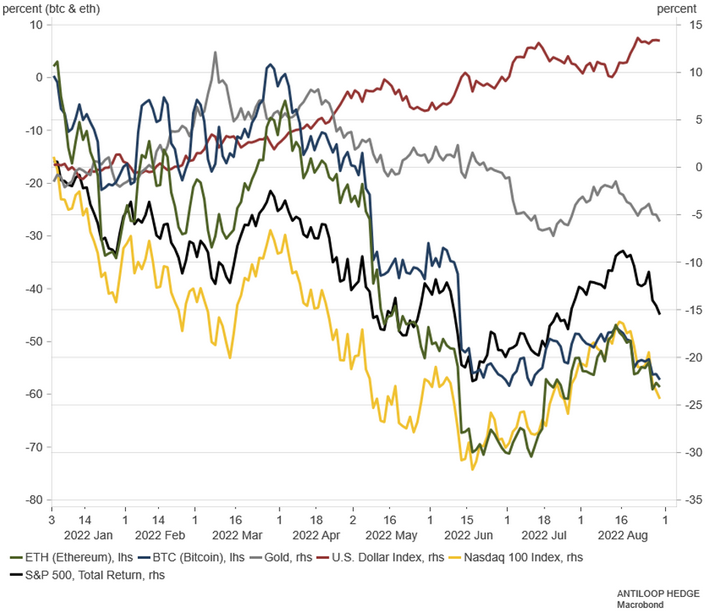

As inflation in the US began to take off last year, many economists predicted that it would be the beginning of the end for the US dollar, while traditional inflation hedges such as gold and real estate, along with the newer crypto assets of Bitcoin and Ether, would act as a hedge during troubled times.

As inflation in the US began to take off last

year, many economists predicted that it would be the beginning of the end for

the US dollar, while traditional inflation hedges such as gold and real estate,

along with the newer crypto assets of Bitcoin and Ether, would act as a hedge

during troubled times.

Almost a year later, the only asset that has

de facto served as a hedge has been the US dollar, which in 2022 has risen

almost 15 percent so far, compared to early favorites Bitcoin and Ethereum,

which have fallen 57 and 58 percent so far, respectively, and gold, which after

a positive start to the year now trading around 6 percent down.

The first months' protection against inflation

has thus been completely backwards to what economic theory says, and to

understand what is actually happening we need to look beyond high inflation

figures and look out over the rest of the world.

It is not only the United States that is

heading into an economic crisis, but the entire world. Interest rates are

rising everywhere, albeit too slowly to catch up with rising consumer prices,

and globally assets are being sold off to flock to what serves as a safe haven

for others outside US borders - namely the dollar.

As long as the outlook for the global economy

looks weak, the dollar will act as a relatively good hedge against other

assets, especially if Powell continues to raise interest rates.

However, that doesn't mean it's too early to

start allocating into alternative assets. In September, "The merge"

takes place in Ethereum, which means that the blockchain goes from Proof of

Work to Proof of Stake. The transition also means that Ether can become deflationary, depending on

how much activity takes place on Ethereum, due to the Ethereum network upgrade EIP

1559 which was adopted and simply explained that parts of the fees that users

pay validators to carry out their transactions are burned, thus leading to

Ether becoming deflationary if enough

transactions are carried out.

Ether, which is now trading almost 70 percent

below its peak at the end of last year, may not be close to an absolute

turnaround in the near term, but for those who believe in the long term that

more and more of the financial services of the future will take place over the

blockchain, it may be time to accumulate at the levels we see now.

However, Bitcoin's role as an inflation hedge

is not fully calculated, in the same way that gold's role is not either. The

function of an asset as an inflation hedge is not measured in days, months,

quarters or even years, but over decades, and so far Bitcoin in its relatively

short lifetime has managed to deliver more value than the US dollar, and gold

in its multi-thousand-year history has maintained its value over time.

Risks

;

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capitalprotected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.