70s on the way back

For a short period, US central bankers called rising consumer price indices "transitory". They tried to sell an illusion of control as they rummaged in their boxes for tools to deal with rising prices that eventually could no longer be hidden from consumers.

Bull & Bear-Certificates

Bull & Bear-Certificates

When the United States suffered from stagflation as a result of intense money pressure in the 1970s, then-Fed President Paul Volcker did the only thing right and raised interest rates to 20 percent to stabilize the economy. That would be completely impossible today. So what assets should you invest in during periods of high inflation? And when is it time to relocate again?

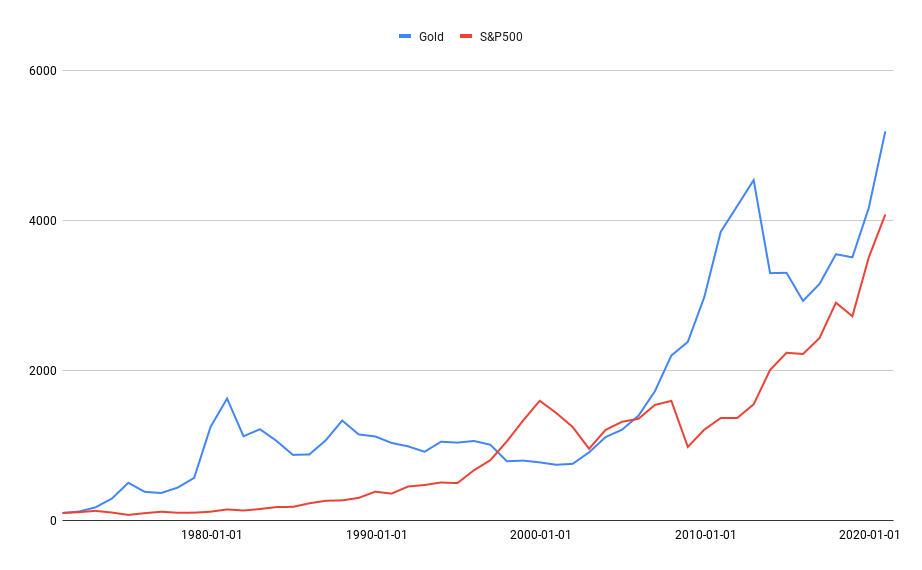

Since the US left the gold standard in 1971, gold has generated higher returns than the S&P 500, including dividends. The annual average for gold is 10.47 percent while the same figure for the S&P 500 is 9.15 percent.

S&P 500 and gold absolute performance, yearly change in USD

Note: Past performance is not a reliable indicator of future results.

There are many who do not believe what they see. Since you started investing in shares, you have learned that there is no asset class that has generated as high a return over long periods as shares. And definitely not a yellow stone. Even Warren Buffett occasionally says, without even looking at the graphs, that gold would never have been a better option.

Although gold has historically yielded more than equities, it is not about choosing the “best” asset and only owning it. Instead, one should invest in owning producing assets, ie shares, on as large a scale as possible, but also hedge with uncorrelated assets to sell when these rise and then buy more shares cheaper.

To succeed, investors need to learn how to time - not just one, but several - markets. In order to achieve as high a risk-adjusted return as possible over long periods, the key is not to own only the “best” asset, but to create a diversified portfolio of several different ones that perform differently during different time periods.

During periods of high economic growth, equities and bonds have historically been a good alternative. In the end, however, it almost inevitably leads to overheating of the economy with too high debt, which later leads to squeezed profit margins for companies and then eventually falling share prices and multiples. Then instead raw materials perform better - and above all gold.

After the last decade's expansive monetary policy and rampant multiples, the situation has rarely looked better for reallocating to gold and other commodities. Stock prices can of course rise further, but the downside risk is all the greater if you compare with, for example, earthquake raw materials or precious metals.

Bull & Bear-Certificates

Link to all gold products

This information is in the sole responsibility of the guest author and does not necessarily represent the opinion of Bank Vontobel Europe AG or any other company of the Vontobel Group. The further development of the index or a company as well as its share price depends on a large number of company-, group- and sector-specific as well as economic factors. When forming his investment decision, each investor must take into account the risk of price losses. Please note that investing in these products will not generate ongoing income.

The products are not capital protected, in the worst case a total loss of the invested capital is possible. In the event of insolvency of the issuer and the guarantor, the investor bears the risk of a total loss of his investment. In any case, investors should note that past performance and / or analysts' opinions are no adequate indicator of future performance. The performance of the underlyings depends on a variety of economic, entrepreneurial and political factors that should be taken into account in the formation of a market expectation.